can you opt out of washington state long-term care tax

WA Cares Fund is a long-term care insurance tax of 058 of gross wages of workers in the state of Washington. Summary of the Washington State Long Term Care Trust Act.

Inside One Family S Coronavirus Nightmare At Seattle Area Nursing Home Reuters

November 1 2021 is the deadline to avoid the new tax by purchasing a private long term care policy.

. If you have a qualifying private long-term care policy in place by this Nov. The video below will walk you through the opt-out process. The first day for workers in Washington state to opt out of the WA Cares Fund started with a crash.

If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1 2021 you have until December 31 2022 to opt-out of the tax. If multiple factors in a column apply to you it may help determine if purchasing long term care insurance and opting out is. If you have private long-term-care insurance LTCI and want to opt out of a new long-term-care payroll tax starting in January you can apply for an exemption with the state of Washington starting today.

So I am not currently a resident of Washington state but I plan to relocate before the end of the year. Starting January 1st 2022 the state will impose a 058 payroll tax on all W-2 employees who reside in Washington. Be at least 18 years of age.

That tax which goes. I already have a private LTC plan offered through my employer that is based in Washington. Turns out they were a bit premature.

Applying for an exemption. Long-term care insurance companies have temporarily halted sales in Washington. The move follows a frenzy of interest in the costly insurance policies prompted by a November 1 deadline to opt out.

Washington states Long-Term Care Trust Act is set to take effect at the beginning of 2022 and the only time to opt out of the new tax is fast approaching. To apply for a permanent exemption you must. But if you want to opt out you may have some trouble.

Opting out of the Washington Long Term Care Tax question. You must also currently reside in the State of Washington when you need care. Opting out of the Washington Long Term Care Tax question.

The Long Term Care Trust Act included a provision allowing people to opt out of paying the 058 payroll tax as long as they could show they had other long-term care insurance in place as of Nov. Have purchased a qualifying private long-term care insurance plan before Nov. The Window to Opt-Out.

Learn more about what qualifies as a long-term care policy under state law. Long-term care policies must have been purchased by November 1 2021 to qualify for the exemption. If you already have a long-term care policy that is satisfactory to you then you probably should opt out.

On the Create an Account page select the Create an Account button to the right of WA Cares Exemption. You must then submit an attestation that. Capped lifetime benefit at 36500 the benefits would pay out a max of 100 a day for up to 365 days.

1 and leave it in place for the states review period you can. Get a Free Quote. Submit an exemption application to the Employment Security Department ESD.

The window to apply for an exemption occurs between October 1 st 2021 and December 31 st 2022. For those who got in before the site crashed minutes after it opened I hear it was easy. The WA Cares Fund which provides eligible adults 36500 for long-term care costs will be funded by a new payroll tax.

After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. Friday the states website to apply for an exemption to the new long-term care. You have one opportunity to opt out of the program by having a long-term care insurance policy in place by November 1 st 2021.

In 2019 the Washington Legislature passed a first-in-the-nation law to create a state-run long-term care program. Washington State Long-Term Care Tax. I have not had success.

For others take a look at the following factors. 3 out of 6 Actives of Daily Living ADLs trigger. 1 to opt out of the states long-term care program which will help pay for nursing care and other support services for people who can no longer care for.

Washington workers have until Nov. An employee tax for Washingtons new long-term care benefits starts in January. The Long-Term Care Trust Act was.

Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares Exemption account. Keep in mind that. You can opt-out permanently if you have your own long-term care insurance policy in place before November 1 2021 that provides equal or better benefits.

The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire. Washington workers have until November 1 of this year to opt out of buying private insurance. Washingtons new long-term care insurance tax charges.

Advocates Sound Alarm About Pilot Program They Say Could Privatize All Of Medicare

Washington Fli And Lti Calculations

Update From The Trio Pre Collegiate Programs Bronx Community College

Want To Buy Apple Stock Here S What You Need To Know Nerdwallet Apple Stock Buy Apple Rainy Day Fund

21 Awesome Products From Amazon To Put On Your Wish List Pen Colored Pens Fineliner Pens

Any Thoughts On This New Long Term Care Tax R Seattle

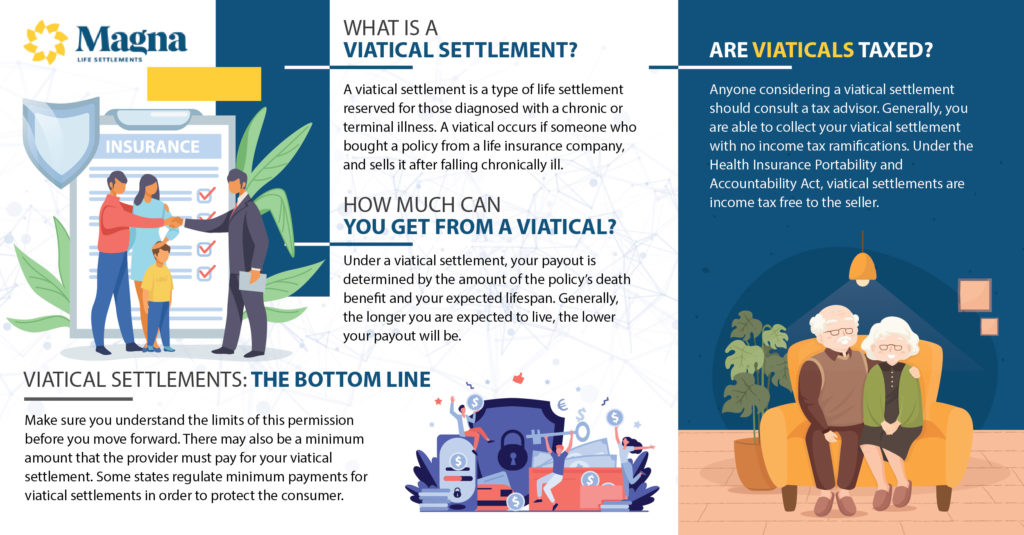

Viatical Settlement Understanding Viatical Settlements In 2021

Top 10 Pros And Cons Of Variable Universal Life Insurance

How To Pay For Nursing Homes Assisted Living

Wealth Managements Insights From Avier Wealth Advisors Our Blog Avier

Frequently Asked Questions About Long Term Care Insurance California Health Advocates

The Death Valley Of Coal Modelling Covid 19 Recovery Scenarios For Steam Coal Markets Sciencedirect